Buyer's Guide: What's Inside

Everything you need to walk into the dealership prepared*

-

Dealer red flags decoded → so you can spot fake fees and keep your money.

-

Exact negotiation scripts → so you can push back politely and get unnecessary add-ons removed.

-

1-minute APR & fee checks → so you can catch padding before you sign.

-

Deal-day checklist → so you can stay organized and leave with a fair deal.

-

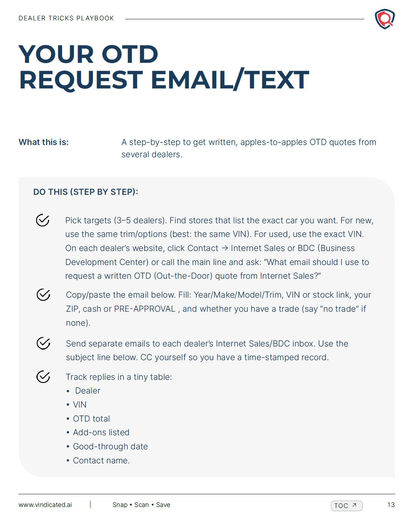

Ready-to-send emails/texts → so you can set expectations and get written quotes upfront.

-

Dealer pushback playbook → so you can handle common “we can’t remove that” replies without freezing.

$39.99 · Instant download · 30-day money-back guarantee

Educational guidance, not legal advice. Results vary by dealer, lender, and state.

Dealer's Tricks (Plain English Guide)

Our promise: We explain car-buying in normal words so you feel calm, clear, and in control.

How VINdicated Makes Money (Current)

We currently do not accept payments from dealerships or lenders for rankings or placement. If we ever use affiliate links or earn commissions in the future, we will clearly label them and disclose compensation.

The Price Game (a.k.a. the monthly payment trap)

What’s the trick?

The car looks cheap online. In person, the price grows with “extras,” or they only talk about a monthly payment so the total cost is hidden.

Think of it like: It’s like booking a $300 airline ticket, but after baggage and seat fees the real total is $450.

How to win:

-

Ask for the Out-The-Door (OTD) price in writing: car price + taxes + DMV + doc/e-file fee. That’s it.

-

Say this: “Can you please email me the itemized OTD price?”

-

If they won’t: that’s your answer—walk.

Financing Tricks (yo-yo calls, padded payments, rate markups)

The common moves:

-

Yo-yo / spot delivery: “Take it home today, bank approval is coming.” Later: “Approve only if you sign worse terms.”

-

Payment packing: Quietly tucking a warranty, GAP, or other add-on into your monthly.

-

Rate markup: Bank approves 8%, you get offered 11%; dealer keeps the difference.

Simple protections:

-

Don’t drive off until your final loan is approved and you have copies of all pages you signed.

-

Work in this order: Price → Financing → Add-ons (one box at a time, in writing).

-

Say this: “What is the buy-rate APR the lender approved for me?”

Best move: Arrive with a pre-approval so you can compare apples to apples.

Tiny math example (rate markup):

A $25,000 loan for 60 months at 8% ≈ $507/mo.

At 11% ≈ $543/mo.

That’s ~$36 more every month just from markup.

Think of it like this: It’s like being told your mortgage is approved, moving in, and then the bank calls to say “actually, pay $300 more a month or get out.”

“Required” Add-Ons (warranty, GAP, nitrogen, VIN etch…)

The pitch: “You need this to get the price/loan.”

Reality: Except taxes/DMV and real lender fees, add-ons are optional. Many are pricier at the dealer.

What to do:

-

Say this: “Please remove any add-ons I didn’t request.”

-

If you want coverage, shop it yourself and compare.

Extended Warranty (Vehicle Service Contract):

GAP-type protection (covers when you owe more than the car is worth after a total loss):

-

Many insurers offer loan/lease payoff (similar idea, not the same contract). Often cheaper than dealer GAP.

Plain difference:

-

Dealer GAP: separate product added to your loan.

-

Loan/lease payoff: an insurance add-on from your auto policy that helps with the “gap” if the car is totaled.

Think of it like this: It’s like buying a phone and being told you must buy their charger for $50, even though the same one is $15 at Target.

Junk Fees

(the easy ones to miss)

Common “why is this here?” items:

Big doc/e-file fees, duplicate DMV/titling, “reconditioning,” “prep,” VIN etch, nitrogen tires, “GPS activation,” “appearance protection.”

What to do:

-

Ask: “Which of these are state-required vs. dealer-chosen?”

-

If it’s dealer-chosen and you don’t want it, remove it or drop the car price the same amount.

Think of it like this: These are the resort fees of car buying, sneaky charges that aren’t part of the real price but get slipped in at the end.

Trade-In & Negative Equity

(rolling old debt into the new loan)

The gotcha:

Owe more than your old car is worth? Some deals hide that negative equity inside the new loan.

Think of it like: putting yesterday’s leftovers in today’s lunch bag. It still comes with you. It’s like paying off last season’s vacation on your credit card while booking the next one. The debt just follows you.

How to keep it clean:

-

Bring your official payoff letter and 2–3 trade offers (CarMax, online buyers, local stores).

-

Make the buyer’s order show the negative equity line clearly.

-

If it looks rough, it’s okay to pause the deal.

Used-Car History (odometer, title “brand,” flood)

Tiny glossary:

-

VIN: the car’s fingerprint (17 characters).

-

Title brand: a permanent label like Salvage, Rebuilt, or Flood—means big past damage.

-

NMVTIS: the official U.S. title database; it shows those brands.

-

NICB VINCheck: free check for theft and many total-loss/salvage records.

Do this in order (fast and simple):

-

Free screen: NICB VINCheck → https://www.nicb.org/vincheck

-

Official brand check: NMVTIS → https://www.vehiclehistory.gov

-

Optional deep dive (paid): AutoCheck

-

Always: get an independent mechanic inspection (even on “certified”).

Red flags made simple: musty smell (flood), mismatched paint panels, damp trunk/carpet, fresh undercoating everywhere, warning lights.

A branded title is like a scar on a medical record — it never goes away, and future buyers and insurers always treat it differently.

Lease Gotchas (now truly simple)

Four words you’ll see:

-

Money Factor (MF): lease interest written tiny. MF × 2400 ≈ APR.

-

Example: MF 0.0020 ≈ 4.8% APR.

-

-

Residual %: what they think the car will be worth at the end. Higher residual → lower payment.

-

Acquisition fee / Disposition fee: setup fee at the start / turn-in fee at the end.

-

Cap cost: the “price” you’re leasing. If you roll add-ons into it, you pay interest on those add-ons.

Leasing is like renting an apartment. The residual is the landlord’s guess of what it’ll be worth after you move out. The money factor is the hidden interest in your rent.

How to shop a lease:

-

Ask in writing: MF, Residual %, Acquisition fee, Disposition fee.

-

Convert MF → APR so you can compare.

-

Avoid rolling pricey extras into the lease.

One-line script: “Can you email me the MF, residual, acquisition fee, and total due at signing for this exact car?”

Spot Delivery (“Yo-Yo”) Explained

What it is:

They let you take the car before the loan is final. Later they call: “You’re only approved if you accept worse terms.”

How to stay safe:

-

Don’t take the car unless the funding is final.

-

If you did take it, be ready to return it if the deal changes.

One-line script: “I’ll wait to take the car until the loan is fully approved and funded.”

Think of it like this: It’s like test-driving a car overnight, then being told you can only keep it if you pay thousands more.

After-Sale Stuff (CPI, refunds, repos)

Things that pop up later:

-

Force-placed insurance (CPI): added if the lender thinks you lacked coverage.

-

Refunds on unused add-ons: If you pay off, refi, or have a total loss, you may be owed a partial refund on things like GAP or some warranties.

What to do:

-

Keep proof of your insurance and challenge any CPI you didn’t need.

-

After payoff/refi/total loss, request “unearned premium” refunds (the unused portion).

Extended warranties can feel like an all-you-can-eat buffet that quietly excludes steak, seafood, and dessert once you read the fine print.

Quick Checklist (save this)

-

Get the itemized OTD price in writing before you visit.

-

Separate the deal: 1) price, 2) trade, 3) financing, 4) add-ons - one at a time, in writing.

-

Ask the buy-rate APR (loans) or the MF/residual/fees (leases).

-

Run NICB and NMVTIS; consider a paid report; get an independent inspection.

-

Don’t accept “pending approval” deliveries unless you’re ready to return the car.

-

If you want warranty or GAP-type protection, compare outside the dealership.

Think of this as your boarding pass before takeoff — no car deal should “fly” until every box here is checked.